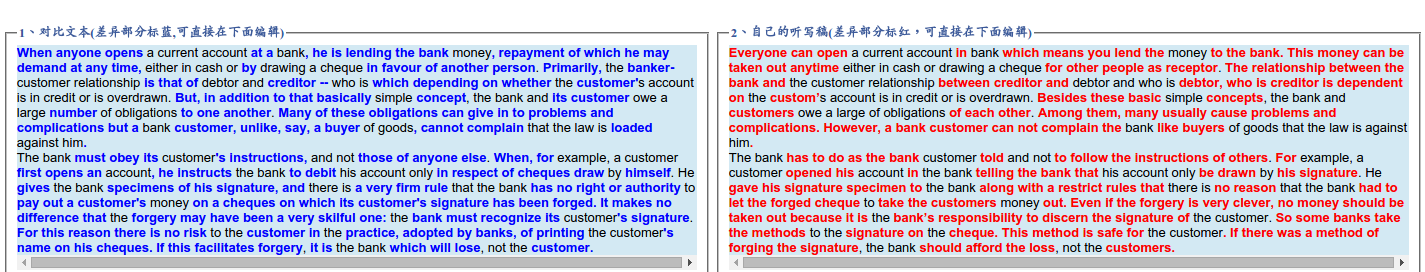

NCE4-Lesson12仿写练习

仿写结果

总结

- repayment of which he may demand at any time, either in cash or by drawing a cheque in favour of another person.

这句话在很短小的句子中表达了复杂的含义和内容,令人印象深刻

- Primarily, the banker-customer relationship is that of debtor and creditor – who is which depending on whether the customer’s account is in credit or is overdrawn.

表达双方关系的不确定和需要协商解决的特点

- cannot complain that the law is loaded against him

抱怨对自己不利的法律–>load against sb 不利于某人

- owe a large number of obligations to one another

双方对对方都负有很大的义务

- It makes no difference that the forgery may have been a very skilful one: the bank must recognize its customer’s signature.

用skilful one来表示伪造高明,这个表达本身非常高明!

背诵

When anyone opens a current account at a bank, he is lending the bank money, repayment of which he may demand at any time, either in cash or by drawing a cheque in favour of another person. Primarily, the banker-customer relationship is that of debtor and creditor -- who is which depending on whether the customer's account is in credit or is overdrawn. But, in addition to that basically simple concept, the bank and its customer owe a large number of obligations to one another. Many of these obligations can give in to problems and complications but a bank customer, unlike, say, a buyer of goods, cannot complain that the law is loaded against him.

The bank must obey its customer's instructions, and not those of anyone else. When, for example, a customer first opens an account, he instructs the bank to debit his account only in respect of cheques draw by himself. He gives the bank specimens of his signature, and there is a very firm rule that the bank has no right or authority to pay out a customer's money on a cheques on which its customer's signature has been forged. It makes no difference that the forgery may have been a very skilful one: the bank must recognize its customer's signature. For this reason there is no risk to the customer in the practice, adopted by banks, of printing the customer's name on his cheques. If this facilitates forgery, it is the bank which will lose, not the customer.